Mortgage Applications Continue to Rise

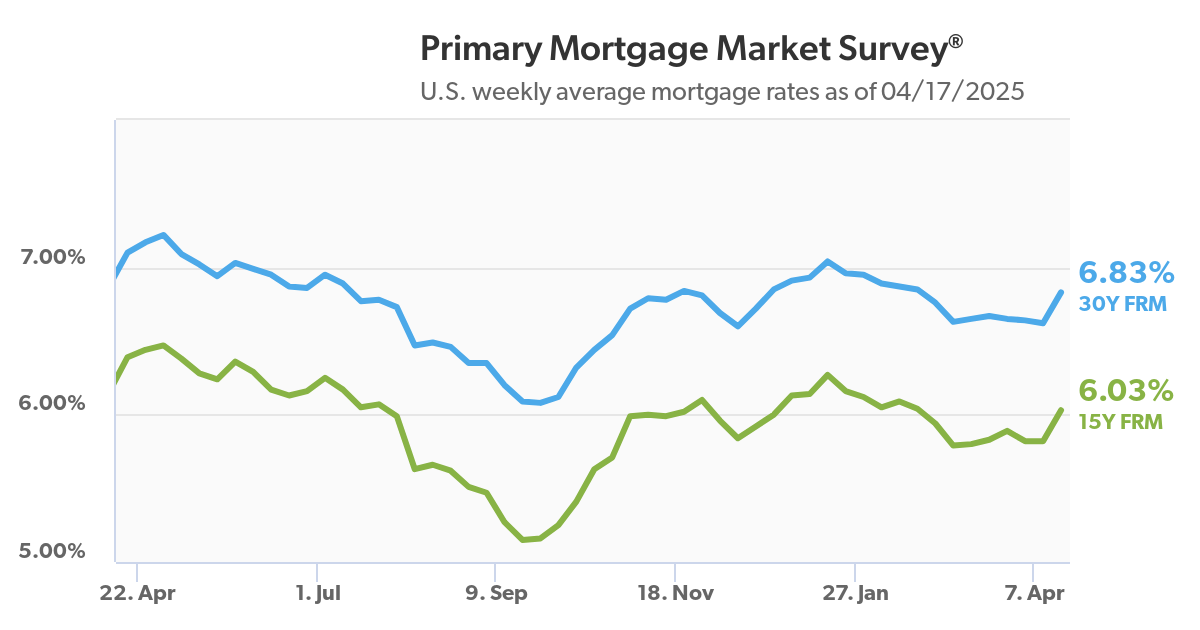

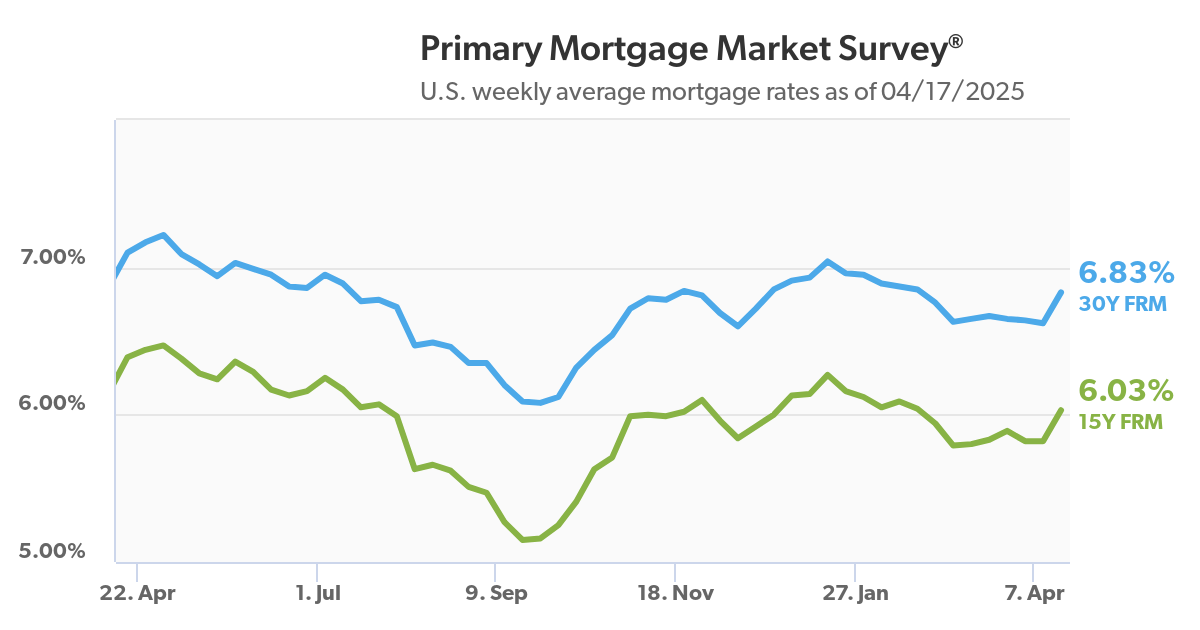

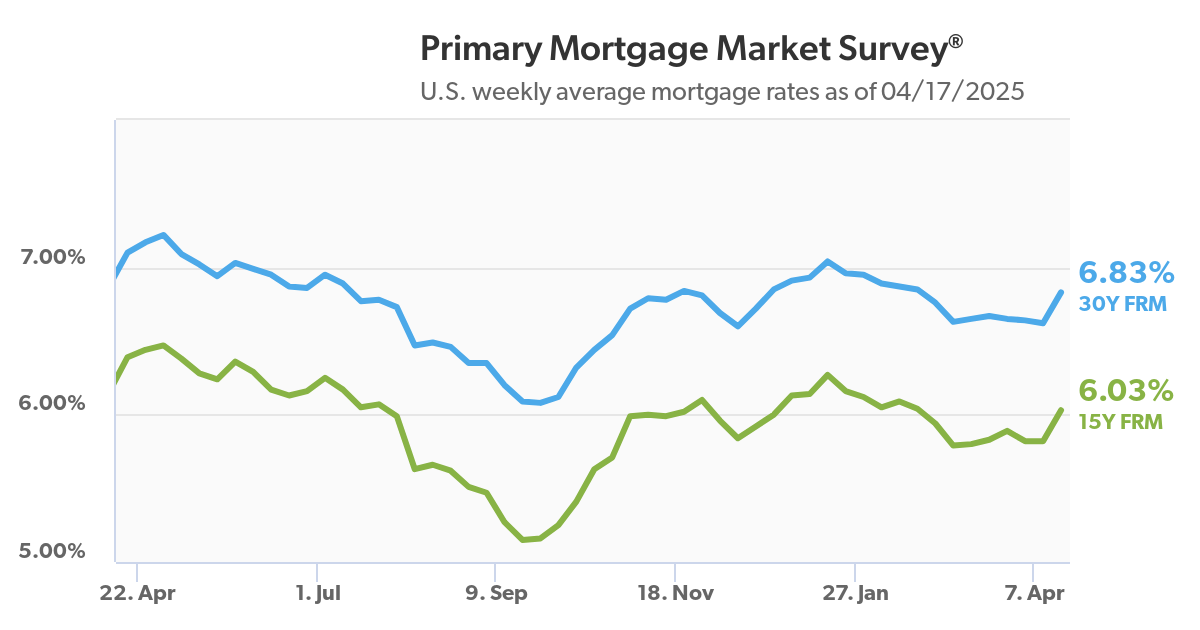

Fall's cooler temperatures are showing zero effect on America's hot real estate market. Since last week, total mortgage applications have risen 6.8%. Applications for refinancing home loans also jumped 9% for the week and an astounding 86% for the year. Millions of borrowers have already refinanced over the past year to take advantage of historically low interest rates, and forecasts anticipate millions more will do so.1

How to Win Bidding Wars in Today's Competitive Real Estate Market

Across the nation, fierce bidding wars are playing out as buyers compete for a limited housing supply. For the best shot at winning, agents should advise clients to look at a house as soon as it hits the market and to make an aggressive offer that could be over asking price. Sellers may also be persuaded by buyers who do not include inspection, appraisal, financing or mortgage contingencies. The highest bid does not always prevail, so never underestimate the power of having buyers write a personal letter to the sellers expressing what they love about the house and the life they hope to live there.3

Retiring in a College Town

A credit score over 700 is generally considered good and positions borrowers for the best mortgage rates. If you want to improve your credit score before applying for a mortgage, Experian recommends paying all your bills on time including credits cards, auto or student loans, rent, utilities, etc.; paying off debt and keeping low balances on credit cards; avoiding opening up credit accounts you don’t need; not closing unused credit cards or applying for too much new credit; and disputing any inaccuracies on your credit report.5Sources: 1CNBC, 3Housing Wire, 5Forbes

Recent Comments