Average Property Prices Reach New High

Data released last week found that average home values recently surpassed the $350,000 mark for the first time ever, inching up 1.4% from May to June 2023. However, buyers haven't thrown in the towel, even though many would-be sellers remain on the sidelines.

Lower-priced metropolitan areas posted the largest monthly growth, with Chicago, Buffalo, Detroit, Hartford and New Orleans seeing 2% or higher growth. The slowest monthly growth was in Austin, Texas, which only managed a 0.4% increase. Other Southern cities, including Jacksonville, Memphis, San Antonio and Birmingham, saw paltry 0.8% increases.

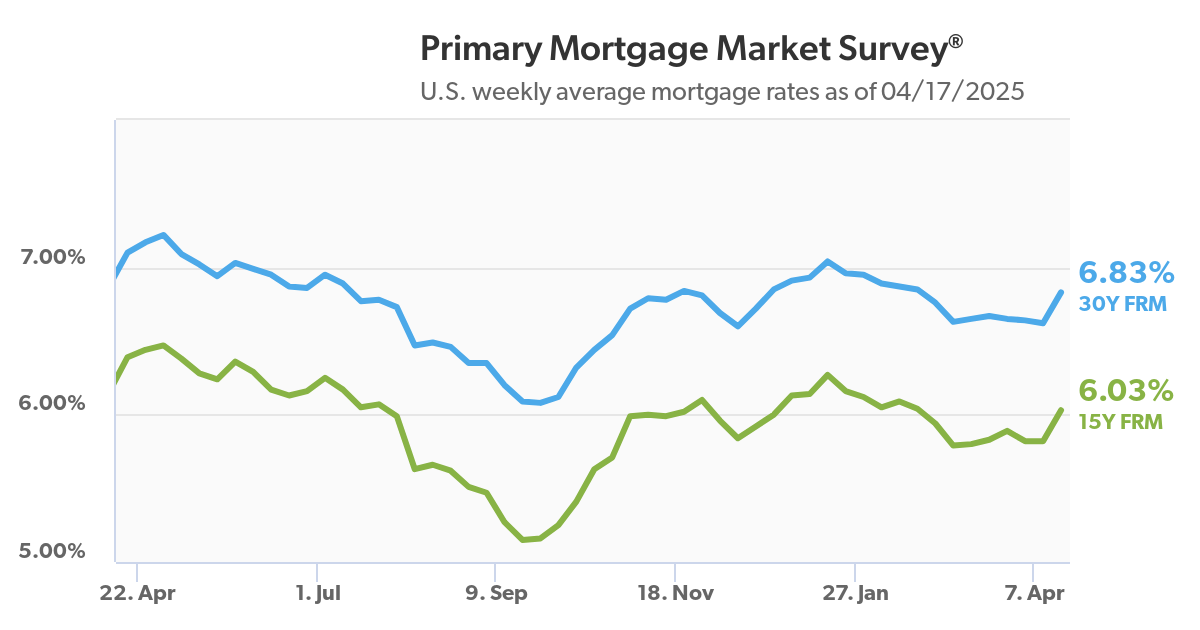

Overall, the shortage of new inventory continues to plague sales. Even though the number of new homes for sale increased 2.4% month-over-month, listings remain down 28% year-over-year. One reason: would-be sellers who managed to snag a mortgage with a low interest rate are reluctant to sell because of today's higher rate atmosphere, even if their home equity has skyrocketed.1

The Unique Power of Referrals

Sometimes it's easy to overlook staying in touch with your closed buyers and sellers, especially when you're busy looking for new clients.

But don't forget—referrals are a major source of new business. Here are some statistics to keep in mind.

- Last year, 63% of sellers reported finding their agent by asking a friend or family member for a referral.

- On average, a home seller has recommended their agent at least once since selling their home.

- Almost 30% of sellers recommended their agent four or more times since their home sale closed.

- Almost 70% percent of home sellers surveyed in 2021 said that they would gladly write a review for their sales agent upon request. When asked about the most important trait they look for in an agent, prospective home sellers indicated that an agent's professional reputation was most important to them.

Gen Z, Millennial Renters Really Want to Buy. Here's How Much.

A housing survey from April 2023 found that many potential homebuyers are willing to go the extra mile to stop renting, especially those aged 18 to 42 and within the Gen Z and Millennial groups. Around 2/3rds of these potential buyers view home ownership as part of the American Dream.

Even more Gen Zers and Millennials—over 80%!—said that they were willing to make a major sacrifice to achieve their goals.

- Around 30% said that they would be willing to buy a fixer-upper or move out of state.

- Around 27% said that they would downsize and buy a smaller property, or move away from their family and friends.

Potential Buyers Need It. Here's Where to Find It.

No matter where the market heads this year, there will always been many would-be buyer clients who are postponing their home purchase because of lack of savings. Inflation has made it more difficult than ever to save for a home purchase. Fortunately, you can join other agents in promoting down-payment assistance...perhaps like those in Houston, Texas.

Recently, the Houston Association of Realtors (HAR) announced its association with Down Payment Resource. Based in Atlanta, Georgia, Down Payment Resource is a one-stop shop for potential home buyers. HAR has also built an exceptionally strong engagement with Houston residents. Its MLS site is the only one in the United States to rank as a Top 20 real estate website.

Down Payment Resource is a nationwide database of down payment assistance and affordable lending programs. The company tracks funding status, eligibility rules, benefits, and more for approximately 2,200 programs in 11 categories.4

How And Why to Explain the Benefits of the MLS

t's possible that your clients have heard you talk about the MLS without really knowing what it is. That's why it's a good idea to explain what it is, and how it's helpful to potential buyers and sellers alike.

You can start by defining the Multiple Listing Service (MLS) as a one-stop shop for all verified, live property listings in their area. Here are a few more talking points:

You can start by defining the Multiple Listing Service (MLS) as a one-stop shop for all verified, live property listings in their area. Here are a few more talking points:

- Mention how every MLS helps promote and enforce equal opportunity in regional housing markets. Local MLS sites give buyers access to the most housing options on the market at any given time.

- Buyers can easily compare the types of properties currently on the market, together with average pricing.

- Sellers get more interest and a better chance of a top price. Between 2019 and 2022, homes listed on local broker marketplaces sold for an average of 14.8% more than off-market properties.5

Sources: 1themreport.com, 2theclose.com, 3bankrate.com, 4nationalmortgageprofessional.com, 5nar.realtor/magazine

Recent Comments