Encourage Would-be Sellers with an Equity Assessment

While some homeowners already have reasons to sell during 2024, there are some who have decided to stay put, even if their property doesn't fit their lifestyle or plans. They're on the fence because of today's higher rates and property prices. However, when you present these prospects with a professional equity report, they may realize that selling now has some big positives.

Although most homeowners understand the concept of home equity, quite a few don't realize how much theirs has grown since 2020. This is why you need to consider researching every prospective seller's home equity—even those who bought their home during 2020 to 2023. This is because home prices have skyrocketed in the past few years.

Presenting "on the fence" sellers with a Professional Equity Assessment Report (PEAR), together with suggestions on how it can make their next home purchase easier, can convert them into confident sellers. For example, post-sale equity can fund a larger down payment for their next home, which can result in a competitively priced mortgage. After they close on their next home, they can finance additions to their investment portfolio or add-ons to their new home with remaining equity funds.

Will Deepfakes Infect the Housing Market?

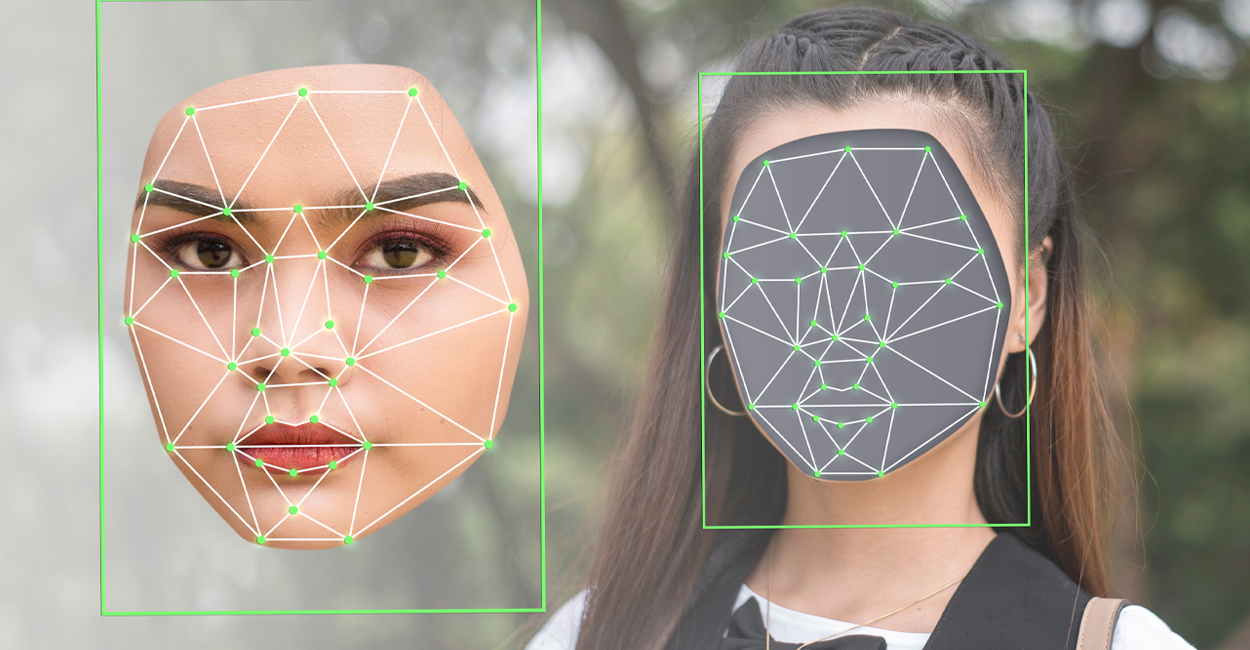

While the internet has changed our world in positive ways, it's also spread a lot of false information and become a playground for scammers. From Photoshopped images to the most recent AI-fueled "deepfakes", there's plenty to look out for within your social media and e-mail. Nobody's immune: for example, Taylor Swift has appeared in explicit deepfake photos.

Altered satellite imagery is a popular source of fake information. For example, a University of Washington study of deep fake geography proved that altering the shape and layout of a neighborhood was so easy that a software program could be written to create these maps and images.

More recently, overseas homebuyers have been fooled by real estate listings that include inaccurate blueprints, non-existent neighborhood features, and fake images. The scammers pretending to be real estate experts improve their chances by:

a. learning what a potential buyer is looking for; then

b. creating deepfake images that resemble their preferred property.

Next, the scammers will encourage a down payment or purchase of this non-existent property.

The first step to prevent a prospect from being taken in by a deepfake is to explain why these listings exist, and how you can help ensure that what they see is what they'll get. Explaining the value of limiting home searches to MLS listings is another strategy for avoiding fakes.2

Generation Z Heads West

While this year's under-30s (aka Generation Z) are still planning an eventual home purchase, many are relocating to areas often abandoned by older generations. For example, many interstate Gen Z migrants are choosing to move to California, challenging conventional beliefs that housing prices encourage moves from expensive states to affordable ones.

Other destinations like Washington, Texas, Colorado, and Virginia are experiencing an influx of educated Gen Zers. A typical migrant to these states may have a four-year college degree, drawn by the prospects of employment and quality of life outside the office. They aren't fazed by today's property prices as most plan to rent upon arrival.

While debt management is important to under-30s, as the average Gen Zer is managing around $20k in debt, home ownership is still a shared goal. This means we have shared opportunities to educate these renters, building relationships that will keep you top of mind when it's ready for them to buy.3

New Here? Here's How to Stay Here.

If you've recently acquired your real estate license, you may be busy if you're in a hot area—but you may be still hunting for prospects. While many agents struggle during their first years in the industry, there are common traits shared by the successful ones. Here are strategies for avoiding four common mistakes.

Having the Wrong Mindset. It's easy to fall into a psychological rut if you're rejected by leads or can't close sales. And if you became an agent with the expectation of being an overnight success, this is another mistake. Remember that long-term success depends on how you handle failure, and that you'll hear more No than Yes answers. Put yourself into the right frame of mind by learning from successful agents and listening to podcasts that teach a positive attitude.

No Advance Financial Plan. Money, or lack of it, is another reason why some agents fail. They don't consider basic expenses such as team splits, taxes, education, marketing and lead generation. Instead, they assume they'll take home big commissions with little or no cash outlay.

Minimal Real-Time Skills. While you studied regulations to become a real estate agent, these aren't the skills required for success. Almost all your clients will expect you to know the ins and outs of a transaction and to be familiar with your sales territory. Most will also expect you to be prompt from the get-go. If you don't pick up a prospect's call, there's a good chance they'll be chatting with another agent by the time you speak to them. Also, keep in mind that around half of your sales will only happen after the fifth talk with a prospect.

Quitting Early. This often happens to new agents who don't understand the business and feel that quitting is their only option when things get tough. They're often the same agents who expected instant commissions, and don't realize that top agents have passion, resiliency and drive. Reaching out for support is important, as isolation rarely leads to rebound. Support doesn't have to come from another agent, as I'm always pleased to answer new agents' questions and introduce the latest home financing solutions.4

Unemployment's Really Low...So Why Are Rates Going Up?

Last month's employment report came in with surprisingly high numbers of job vacancies. Our economy gained 353,000 jobs last month, which is almost twice the estimated 185,000.This tells us that the labor market is even stronger than economists were expecting.

That's positive for homebuyers because it means more Americans have more money in their pockets–but negative because it pushes up mortgage rates. Here's why a strong job market is both good and bad for the housing market.

High employment means more consumers can afford to buy homes and make monthly payments. It could also encourage some homeowners to sell and move up to a better house.

On the flip side, a strong job market implies slightly higher mortgage rates for longer, as the Federal Reserve hasn't stopped their efforts to keep inflation from re-appearing. This will probably result in a delay in rate cuts. For example, the expected rate cut for March probably won't happen, and the jobs report is one of the reasons why.

Here's the takeaway: since mortgage rates are unlikely to see a big change during the next months, it tells us that 2024 is not a great year to try to "time the market" for financial gain (a strategy that rarely works). Instead, invite potential sellers to consider their long-term future. For example, will moving now improve their overall quality of life, lower their monthly expenditures or both?5

Sources: 1keepingcurrentmatters.com, 2theamericangenius.com, 3nationalmortgageprofessional.com, 4theclose.com, 5redfin.com

Recent Comments